Pillar 3a has gone mainstream — nearly four out of five employed people now have a 3a solution. But the bigger tax lever, Pillar 2 buy-ins, is still quietly used by only a small share of people — usually those who already understand how powerful the system can be when you use the rules to your advantage. For many others, the second pillar still feels like a black box. Almost nine out of ten insured people know buy-ins exist, yet only about a third of 51‑ to 65‑year‑olds have ever used them. It’s one of those opportunities that well‑advised, wealthier individuals tend to spot early, while everyone else often discovers it far too late.

And once you look beyond this year’s tax return, the two options behave very differently.

One is like planting an oak tree — slow, steady, and quietly reliable. The other is like planting a fast‑growing bamboo — flexible, investable, and shaped by time.

So the real question isn’t “Which one is better?” It’s “Which one fits the way you want to build your future wealth?”

In this guide, we’ll break it down in plain language: when a buy‑in gives you the biggest advantage, when a 3a quietly outgrows it through compounding, the traps people overlook (hello, 3‑year rule), and how to combine both if you want the best of both worlds.

And here’s the part most people underestimate: both buy-ins and 3a contributions reduce your income at your marginal tax rate — the rate applied to the very last franc you earn. For higher earners, that can easily be 30–40%. Which means every CHF 10,000 you put in can save you CHF 3,000–4,000 in tax.

It’s one of the simplest ways to save money in Switzerland — yet also one of the least understood.

If you’ve ever wondered where your next saved franc should go, this guide gives you a clear, practical way to feel in control and optimise your finances.

Before we start, a quick note: this post goes a little deeper into Swiss pension planning — the kind of behind-the-scenes levers most people never hear about, but that can quietly shape your long-term wealth. If you’re not yet fully comfortable with how the Swiss pension system works, I’d suggest reading my overview first. It’ll make everything here feel much clearer and easier to follow.

What a Pillar-2 Buy-In Actually Is (and Isn’t)

A Pillar-2 buy-in is one of those quiet financial levers most people have heard of, but very few truly understand. At its heart, it’s simply a way to fill the gaps in your occupational pension — and reduce your taxable income at the same time. The Swiss system allows you to “catch up” on contributions you didn’t make earlier in life. The catch? Like most powerful tools, it comes with rules.

Why You Might Have Gaps

Most people have pension gaps without realising it — even people who’ve lived in Switzerland for years. You might too.

Maybe you moved here later in your career.

Maybe you worked part-time while raising children, took a career break, or had years below the BVG threshold.

Maybe your salary jumped, suddenly creating new “buy-in room” you didn’t have before.

What surprises most people is the size of these gaps.

To give you a sense of scale: my pension fund allows up to CHF 1.3 million in buy-ins per year.

If you’re an expat like me, you likely have substantial room — often hundreds of thousands, not the modest CHF 7,000-a-year limit of Pillar 3a.

These gaps aren’t mistakes — they’re simply life happening. And buy-ins were designed precisely to close them.

If you remember from my Swiss pension system overview, the first and second pillars together are designed to give you roughly 60% of your final salary in retirement.

The bad news? If you have gaps, you won’t get anywhere near that level unless you close them.

The good news? A buy-in lets you do exactly that.

The Upside

The appeal of a buy-in is straightforward: you get a large, immediate tax deduction — often far bigger than anything a 3a can offer. At the same time, your pension capital grows. The mandatory part earns a guaranteed minimum interest rate of 1.25% in 2025 (BVG minimum rate, 2025 – BSV), and many funds credit more, often around 3–4% depending on their performance.

It’s one of the few places in personal finance where a tax saving and long-term compounding work quietly together.

The Trade-Offs

But buy-ins aren’t flexible money. Once inside the pension system, the funds are locked until specific life events. If you withdraw them too soon — for example, to buy a home — the three-year rule applies. And you’re always tied to your pension fund’s investment returns and conversion rates.

A buy-in is, in many ways, the financial equivalent of planting an oak tree: stable, steady, and slow to move. It rewards patience and suits people who prefer certainty over liquidity.

If that matches the way you want to build your future wealth, a buy-in can quietly become one of the smartest decisions you make.

Smart Use Case: The “Mortgage Loop”

If you’re a homeowner, your Pillar 2 can be surprisingly powerful.

Instead of directly repaying a mortgage, you can buy in, get the tax deduction now, and later withdraw via WEF to repay the mortgage.

It sounds abstract, so let’s walk through a quick example: Imagine you were planning to repay CHF 100 000 of your mortgage.

| Step | Amount | Tax Impact |

|---|---|---|

| Buy-in | CHF 100 000 | Immediate tax saving (marginal tax rate 35 %) → CHF 35 000 |

| Withdraw via WEF (later) | CHF 100 000 | Pay 7 % withdrawal tax → CHF 7 000 |

| Net gain | ≈ CHF 28 000 saved |

You still achieve the same end goal — owning your home — but save thousands in tax along the way.

(Just remember the 3-year block, and that sale proceeds must usually return to a pension fund.)

I wrote a full post explaining how the smart mortgage loop works: Do You Want to Buy Your Home 28% Cheaper? Here’s Smart Mortgage Loop.

What’s the “marginal tax rate”?

It’s the tax percentage applied to the last (or next) franc you earn — not your whole income.

If your average tax rate is 20 % but your marginal rate is 35 %, every CHF 1,000 you deduct saves about CHF 350 in tax.

That’s why buy-ins and 3a contributions are so powerful: they reduce income at your highest taxed level.

What a Pillar 3a Contribution Is

If Pillar 2 is the big lever in the Swiss system, Pillar 3a is the quiet little workhorse most people already know. Nearly everyone has one these days — and for good reason. It’s simple, predictable, and does exactly what it says on the tin.

The rules are straightforward: you put in up to CHF 7,258 per year (2025, if you’re employed with a pension fund), you get a tax deduction, and the money grows — often in equity funds with a much higher long-term return than a pension fund can offer. If you’re self-employed without a pension fund, the limit is much bigger — up to CHF 36,288 (20% of your net income).

One small twist most people haven’t heard yet: the rules have just changed in 2025.

You can now catch up on missed 3a contributions — a quiet little opportunity that suddenly makes Pillar 3a much more powerful than its reputation suggests. I’m explaining the details (and how to use it wisely) in my next post: pillar-3a-retroactive-contributions-2025-reform-buy-in

And unlike a 2nd pillar buy-in, in 3a pillar you get to choose where this money lives. A bank, a digital provider, a high-equity fund… you have a menu, not a fixed meal. If you don’t like one provider, you can simply switch to another — no need to ask anyone’s permission.

Of course, every tool has its trade-offs.

A 3a isn’t meant to solve big problems on its own. The deduction limit is small, the money is locked until retirement (or a few special life events), and the market can be bumpy in the short term. But over 10, 15, 20 years? Markets usually reward patience — just like Buffett’s favourite investments.

Think of the 3a as fast-growing bamboo. You plant a little each year, almost without noticing, and let compounding do its quiet work. Then one day you look up — and it’s grown far taller than you expected.

It won’t close six-figure gaps in your pension fund. It won’t solve every tax problem. But it will quietly nudge your future wealth in the right direction, year after year — and you stay in full control the entire time.

For many people, a 3a is the first step toward long-term financial confidence.

For others, it’s the perfect companion to larger buy-ins.

And for almost everyone, it’s one of the simplest ways to turn today’s tax savings into tomorrow’s freedom.

You’ve seen the theory — 2nd pillar buy-ins give you size, 3a gives you flexibility, and both can save you serious tax.

But numbers only become real when you run them through a simple, everyday scenario.

So now let’s take one concrete pot of money, keep the assumptions honest, and let the math tell the story.

Here are two examples I love because they show something people rarely realise:

the “best” option changes completely depending on your time horizon.

Example 1: CHF 50 000 to Invest — Where Should It Go?

Let’s assume you have CHF 50 000 sitting quietly in your savings account — not doing much. You’re wondering what to do with it.

You’d like to reduce your 2025 tax bill, but you also want to invest it smartly for long-term growth.

We’ll compare two realistic strategies:

🟦Option A: Invest the full CHF 50 000 as a Pillar 2 buy-in

🟩Option B: Max out your 3a (CHF 7 258) and invest the remaining CHF 42 742 in a low-cost global ETF

Assumptions

| Parameter | Value | Explanation |

|---|---|---|

| Annual income | CHF 200 000 | Typical upper-middle income in Zurich region |

| Marginal tax rate | 32 % | Combined federal + cantonal + communal rate |

| Investment horizon | 15 years | Until retirement or early financial independence |

| Withdrawal tax | 7 % | Lump-sum tax on payout (average for Canton Zurich) (Taxation of pension withdrawals) |

| Expected returns | Pillar 2 = 2 % p.a., Pillar 3a = 4 % p.a., ETF = 5 % p.a. | Realistic long-term assumptions based on risk profile |

Results at a Glance

| 🟦Pillar 2 Buy-In | 🟩Pillar 3a + ETF | |

|---|---|---|

| Amount invested | CHF 50 000 | CHF 50 000 |

| Immediate tax saving | CHF 16 000 | CHF 2 258 |

| Value at retirement | CHF 67 400 | CHF 101 700 |

| Withdrawal tax | – CHF 4 700 | – CHF 885 (on 3a only) |

| Final after-tax total | CHF 78 700 | CHF 103 100 |

Difference: ≈ CHF 24 400 in favour of the 3a + ETF strategy

What This Means

- The buy-in delivers a big immediate tax break and a steady, guaranteed return.

- The 3a + ETF strategy offers smaller short-term tax savings but faster compounding growth, ending roughly CHF 24 000 ahead after 15 years.

- Both have their place:

- 🟦 Pillar 2 buy-in → for stability and tax efficiency now

- 🟩 3a + ETF → for growth and flexibility long-term

Example above is the long-term picture — but what if your timeline is shorter than 15 years?

Maybe you plan to buy property, move abroad, or simply retire sooner? Example 2 shows how the same CHF 50 000 behaves when time is on your side — or isn’t. Time changes everything, and the smartest choice at 15 years is not always the smartest choice at 3 years horizon.

Example 2 — How Time Horizon Changes the Outcome

The winner between Pillar 2 buy-ins and 3a + ETF depends heavily on how long you keep the money invested.

Money behaves differently depending on how long you let it sit.

Give it three years and tax savings dominate.

Give it seven and the race tightens.

Give it fifteen and compounding starts showing off.

Let’s see how the same CHF 50 000 example plays out over 3 years, 7 years, and 15 years.

Results by Horizon

| Horizon | Pillar 2 Buy-In (2 %) | Pillar 3a + ETF (4 % / 5 %) | Winner |

|---|---|---|---|

| 3 years | 50 000 × (1.02)³ = 53 060 + 16 000 tax saving − 7 % tax (≈ 3 700) = CHF 65 360 | 3a ≈ 8 165 − 7 % tax + 2 258 = 9 861 ; ETF ≈ 49 530 → CHF 59 400 total | 🟦 Pillar 2 Buy-In (+ ≈ CHF 6 000) |

| 7 years | 50 000 × (1.02)⁷ = 57 420 − 7 % tax (4 020) + 16 000 = CHF 69 400 | 3a ≈ 9 540 − 7 % tax + 2 258 = 11 130 ; ETF ≈ 60 200 → CHF 71 300 total | 🟩 3a + ETF (+ ≈ CHF 1 900) |

| 15 years | 50 000 × (1.02)¹⁵ = 67 400 − 7 % tax (4 700) + 16 000 = CHF 78 700 | 3a ≈ 12 655 − 7 % tax + 2 258 = 14 028 ; ETF ≈ 89 040 → CHF 103 100 total | 🟩 3a + ETF (+ ≈ CHF 24 000) |

Interpretation

- Short term (≈ 3 y): The buy-in clearly wins. The tax saving dominates; markets haven’t had time to compound.

- Medium term (≈ 7 y): Nearly even. The 3a + ETF begins catching up as returns accumulate.

- Long term (≈ 15 y): The 3a + ETF overtakes and ends roughly CHF 24 000 ahead after taxes.

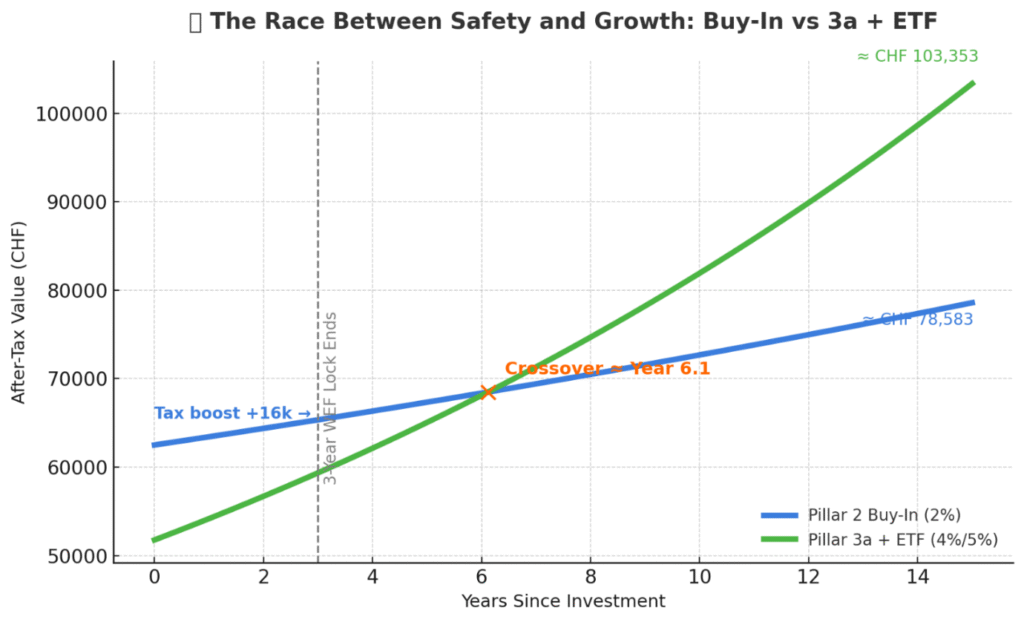

What the chart shows:

At the start, the Buy-In (blue) gets a big tax head start — it’s the safer, slower runner.

But over time, the 3a + ETF (green) compounds faster and overtakes around year 6.

By year 15, the growth investor finishes about CHF 24 000 ahead.

Both win in different ways: the blue line gives peace of mind and tax relief, the green line delivers long-term wealth.

Actuary’s Angle — The Power (and Danger) of Assumptions

Here’s the thing about comparing strategies: the math only looks clean because the assumptions are clean.

Change the return, the tax rate, or the holding period — and the winner can flip faster than you’d expect.

I’ve analysed long-term returns of many Swiss pension funds, and while 2% is a reasonable average, reality is far messier.

Some funds credited 4% over the last 15 years.

Others barely reached 1.5%.

Same country, same system — completely different outcomes.

That’s why the smartest thing you can do is run your own numbers.

Your pension fund, your marginal tax rate, your horizon.

The calculator I’ll be sharing soon lets you plug in those inputs and see your personal picture — not the generic one — if you’d like the next guide when it’s ready, you can sign up here.

The examples above are intentionally simple, but the conclusion holds true:

- Short time horizon or near-term withdrawal → Pillar 2 buy-in usually wins (the tax deduction dominates).

- Long time horizon → a 3a or ETF tends to pull ahead (effect of compounding finally shows up).

If you’re curious how results shift under market corrections or different return paths — you’ll enjoy the next post.

Coming next: “When Markets Turn: Testing Pillar 2 vs. 3a in Volatile Years.”

Conclusion

If there’s one thing the examples make clear, it’s this:

there is no universal winner — only the strategy that fits your timeline, your flexibility needs, and your style of building wealth.

A buy-in is your oak tree: slow, steady, predictable, and unbeatable when you need a big tax win in the near term.

A 3a (especially with investments) is your bamboo: flexible, fast-growing, and able to outpace everything if you give it time.

That’s why the smartest question isn’t “Which pillar is better?”

It’s “Where does my next franc do the most good for me?”

Here’s the at-a-glance comparison many people wish they had earlier:

Pillar 2 vs Pillar 3a — At a Glance

| Criterion | Winner | Why |

| Immediate tax savings | Pillar 2 Buy-In | Deduction can be 10–100× larger than the 3a cap. |

| Expected long-term growth | 3a (invested) | Equity-based 3a portfolios usually outgrow BVG interest over 12–15+ years. |

| Flexibility & liquidity | 3a | Portable, investable, and staggerable. |

| Withdrawal taxation | It depends | Canton, staggering options, and pension rules matter. |

So what should you do?

Think in horizons:

- Short horizon (3–5 years)

A buy-in usually wins. The tax deduction does the heavy lifting. - Medium horizon (≈7 years)

Close race. Taxes vs. growth — the balance can tilt either way. - Long horizon (10–20 years)

A 3a + ETF strategy tends to pull ahead as compounding shows its strength.

Most people end up using both, just at different moments in life.

Your second pillar fills the big structural gaps.

Your 3a gives you flexibility, investment choice, and long-term acceleration.

Used together, they’re not rivals — they’re teammates.

So now I’m curious — if you had CHF 50 000 to place today, which route would you choose — buy-in or 3a + ETF — and why?

FAQ

1. Should I max my 3a first or do a Pillar 2 buy-in first?

It depends on your horizon.

If you want the biggest tax win this year, a buy-in usually wins because the deduction room is so much larger.

If you’re investing for 10+ years, an equity-based 3a often grows faster thanks to compounding.

Most people end up doing both — just in different years and for different goals.

2. Can I contribute to 3a and do a buy-in in the same year?

Yes — in most cases you can do both.

Many people max out their 3a each year (because it’s simple and flexible) and use buy-ins opportunistically when their budget, taxes, or life situation make it attractive.

3. How do I check my Pillar 2 buy-in room?

Your pension fund (Pensionskasse) calculates this for you — and it’s usually shown on your annual pension statement under something like “maximum possible buy-in,” or “Einkaufspotential.”

If it’s not listed, just email your pension fund and ask for your buy-in capacity; they’ll send you an official calculation.

Remember: the number can be surprisingly large, especially if you moved to Switzerland later, had part-time years, or changed employers.

4. How many 3a accounts should I have?

A good rule of thumb is 3–5 accounts, filled gradually.

This lets you stagger withdrawals in retirement and avoid paying higher progressive tax on a single large payout.

You don’t need to open them all at once — spread them over the years as your contributions grow.

Thanks for super intresting comparison. I’m wondering how does the 3-year rule actually work in practise? If someone does buy-in now but want to withdraw later for property, could that block them?

Great question — the 3-year rule is one of those small details that’s easy to miss.

In practice, you can still withdraw money for a property right after a buy-in, even within 3 years. The catch is that the tax office may treat that buy-in as if it was never tax-deductible and reclaim the tax savings. So it’s less “you’re blocked” and more “you lose the tax advantage if you withdraw too soon.”

That’s why I usually tell people: if you think a property purchase is on the horizon, go easy with big buy-ins until your timeline is clearer. And given how long it can take to find a place in Switzerland, those 3 years often pass faster than expected.

I’m also planning to write a full guide on buying property in Switzerland — feel free to check back soon!