A quiet but powerful reform is coming to Switzerland’s pension world — one that finally gives you a second chance with Pillar 3a.

Starting with the 2026 tax year, you’ll be able to catch up on missed 3a contributions for 2025 and beyond, something that was completely impossible until now.

And who benefits the most?

Anyone whose income doesn’t move in a straight line.

Contractors, entrepreneurs, parents who take time off, people with big bonuses or one-off deductions — anyone whose tax rate swings from year to year. They can now skip contributions in low-income years and buy them back in high-income ones, when the tax deduction is worth much more.

To see where Pillar 3a sits within the broader Swiss pension system, click here for a simple explanation. If you’re curious whether a Pillar-2 buy-in might be an even stronger lever for you, you can explore that in this guide.

Here’s how the new rules work — and how you can make the most of them.

What’s New

Starting in 2026, both employees and the self-employed will finally be able to catch up on missed Pillar 3a contributions — something that simply didn’t exist before.

The idea is straightforward: if you skipped a year, you can buy it back later. But to keep things clean, the law adds a few conditions.

You can make a retroactive 3a payment if:

- You were working and paying AHV in the year you want to catch up.

- You’re working and paying AHV now, in the year you make the buy-in.

- You’ve already paid your regular 3a contribution for the current year — the buy-in is always on top of that, never instead of it.

- You haven’t started withdrawing your 3a old-age benefits.

(Good news: a WEF withdrawal for buying a home does not block future buy-ins.)

And here’s the fine print that matters most:

You can only catch up years from 2025 onward. Anything before 1 January 2025 is permanently locked.

You can buy back up to 10 years of missed contributions — but always within the rules of the year you’re buying in.

There’s also an annual cap.

A buy-in can never exceed the “small” Pillar 3a limit — defined in law as 8% of the upper BVG threshold.

For 2025 and 2026, that amount is CHF 7,258.

For self-employed people without a pension fund, regular 3a contributions can still go up to CHF 36,288 per year.

However, retroactive buy-ins are always capped at the “small” 3a limit (CHF 7,258 in 2025/26) – even for the self-employed. In other words, you still get the large annual room, but the catch-up room is limited.

In practice, this means:

- Your buy-in each year is capped at the same limit as your normal 3a contribution (if you have a pension fund).

- You can combine both in the same year — your regular 3a plus a buy-in up to the cap.

(Here’s the link to the official regulation: fedlex.admin.ch – BVV 3, Art. 7a, effective 1 Jan 2025)

Now let’s look at an example to see how these pieces fit together.

How It Works

Picture this. It’s 2030.

You’re reviewing your finances and suddenly realise that between 2025 and 2029, life was busy — new job, move, kids, travel — and you never quite managed to make the full Pillar 3a contribution each year.

In the old system, those years would have been gone forever.

In the new system, you can simply go back, fill the gaps, and deduct the buy-ins from your taxable income for 2030. Your bank or 3a provider will check your eligibility and issue a clean certificate you can attach to your tax return. Simple, tidy — painless.

Example: The Catch-Up Advantage

Now let’s make it even more concrete.

Imagine you moved to Switzerland and only discovered Pillar 3a a few years into your life here. By the time you realised what you’d missed, several years had already slipped by without contributions.

Under the new rules, you can start catching up.

Here’s what it might look like in a single year:

| Parameter | Value |

|---|---|

| Annual income | CHF 120 000 |

| Marginal tax rate | 30 % |

| Regular 3a contribution (2030) | CHF 7 000 |

| Buy-in for one missed year | CHF 7 000 |

| Immediate tax saving | CHF 4 200 |

Together, a CHF 7,000 regular contribution and a CHF 7,000 buy-in create a total deduction of CHF 14,000 — which, at a 30% marginal rate, puts CHF 4,200 straight back into your pocket.

If you have several missed years, you can repeat this process in future years — each time using the deduction when it’s worth the most to you.

Who Benefits Most?

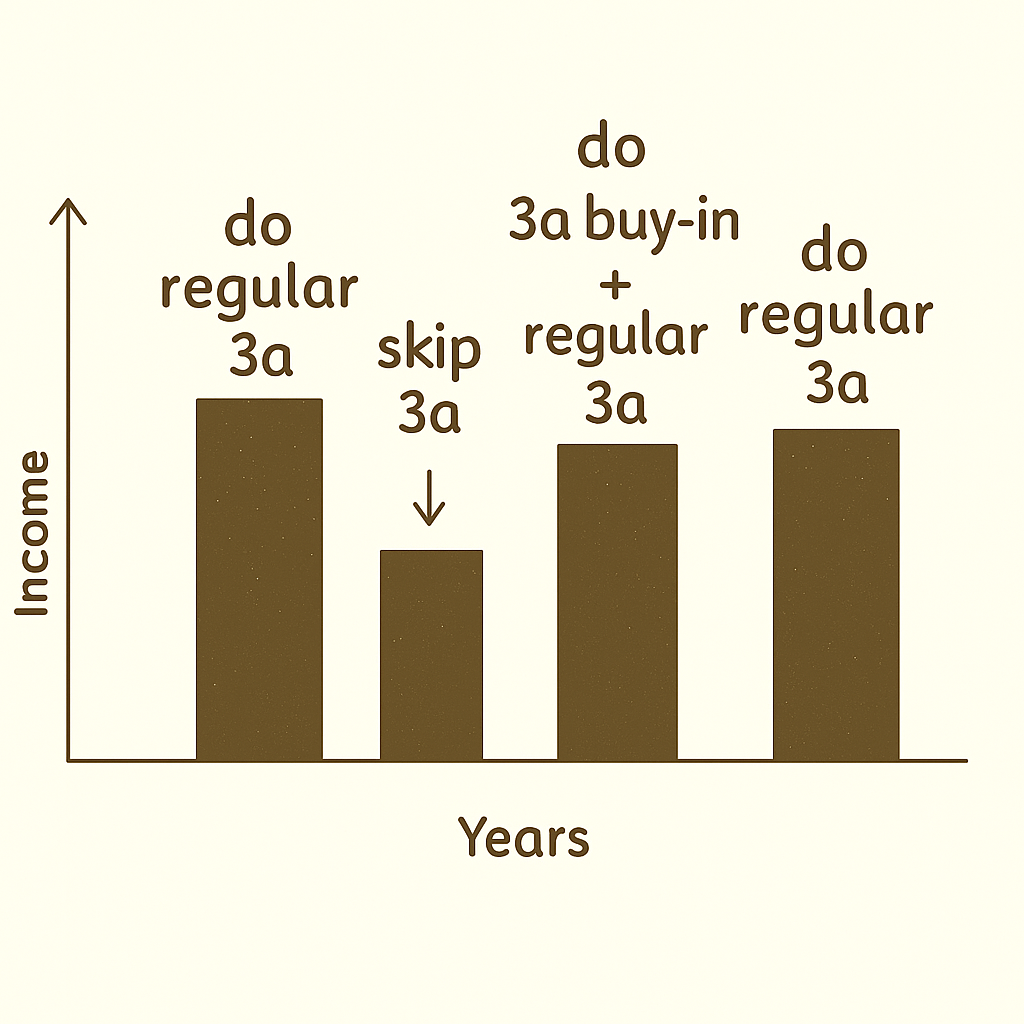

If you want the short answer: it’s the people whose financial lives don’t move in a straight line — those with irregular income from year to year.

Contractors. Entrepreneurs. Parents who take time off. Anyone with a large bonus component — or a year with unusually large deductions, like a major home renovation. In short: people whose income chart looks a little more like a mountain range than a flat Swiss field.

Why?

Because these are the people who can use the new rule the way a good investor uses market cycles — leaning in when the tax value is high, easing off when it’s low. They can optimize between low marginal tax years and high marginal tax years.

Let’s look at a few everyday stories.

Parent who takes six months off work.

Your marginal tax rate drops from 30% to 15%. In a year like that, forcing yourself to pay into Pillar 3a might not be the smartest use of cash — the deduction would save only CHF 1,050 (15% × 7,000).

But when you return to full-time work and your marginal tax rate rises again, the buy-in suddenly becomes a much stronger tool. You get a bigger deduction precisely when it matters most: the exact same CHF 7,000 suddenly saves CHF 2,100 in taxes.

Same contribution. Same effort. Double the benefit — simply because it’s done in the right year.

Self-employed consultant with a 2nd Pillar

Some years feel like harvest season, others like a drought. In the slow years you don’t need the deduction.

In the big years, you absolutely do.

Now picture your marginal tax rate jumping from 20% to 40% this year. Suddenly, the same CHF 7,258 contribution doesn’t save you CHF 1,452 anymore — it saves you CHF 2,903.

A skipped contribution today becomes a strategic buy-in tomorrow.

And yes — even the “Oops, I just forgot” crowd gets a second chance.

Life doesn’t always run on tidy spreadsheets — cash gets tight, priorities shift, bank transfers slip through the cracks. Or, as my neighbour always says with a smile: life is busy.

The old system punished you for it.

The new one is far more forgiving.

For all these groups, the 2025 reform isn’t just a technical adjustment.

It’s a quiet little gift: the chance to turn messy financial years into an advantage instead of a penalty.

Honestly, I think it’s one of the smartest improvements Switzerland has made to the private pension pillar.

Who Probably Doesn’t Need It

Someone whose income is as flat as a Swiss field.

If your income looks the same every year — steady job, steady salary, steady tax rate — then buy-ins don’t add much magic.

In that case, the old wisdom still applies: don’t skip your 3a.

Start early, invest consistently, let compounding do the heavy lifting.

Self-employed consultant without a 2nd Pillar.

You are in a group that stands to lose the most if you misunderstand how the new rules work: the self-employed without a pension fund.

Your annual 3a allowance isn’t CHF 7,000. And here we’re talking about real money — you can contribute up to CHF 36,288. Miss one of those years, and the opportunity is gone forever. The buy-in rules only let you catch up using the small limit — around CHF 7,000 — no matter how large your original room was.

So while employees mainly shift deductions between high- and low-income years, a self-employed person who skips a big year gives up a one-time tax advantage that can never be restored. In their case, the cost of a missed contribution can be measured not just in timing — but in tens of thousands of francs.

When It Starts — and Why It Matters

The reform officially lands on 1 January 2025, but here’s the part most people miss:

you can’t actually use it until 2026. That’s the first year when buy-ins for missed contributions become possible.

And there’s one more important rule:

you can only catch up on gaps from 2025 onward. Anything before that stays in the “too late” basket forever.

From 2026, you can fill in up to ten years of gaps, one year at a time, with each buy-in capped at the “small” Pillar 3a limit for that year.

It sounds technical, but the impact is surprisingly human.

Before this reform, if you missed a 3a contribution, it was gone — like a train that left the station two minutes early. No catching up, no second chances.

Now, at least for the years ahead, the system is much more forgiving. You can turn a messy year into a strategic one. You can shift deductions into the years when they matter most. You can turn past gaps into future gains.

For anyone who cares about long-term planning in Switzerland, this is one of the most practical — and quietly powerful — changes we’ve seen in years. Small tweak on paper. Big difference in real life.

Frequently Asked Questions (FAQ)

1. Can I catch up for years before 2025 if I didn’t know about Pillar 3a?

No — and this is one of the questions I’m asked most often.

The new catch-up rule applies only to years starting 1 January 2025 onward.

Anything before that date is permanently locked, even if:

- you weren’t living in Switzerland yet,

- you didn’t know 3a existed, or

- you simply forgot to contribute.

Why?

Because the reform was intentionally designed not to be retroactive.

Lawmakers wanted a system that remains stable, predictable, and easy to administer — and allowing buy-ins for older years would have opened the door to very large retroactive tax deductions.

2. Can I catch up several missing years at once (for example, buy back five years in a single year)?

No. This is another very common misunderstanding.

The rules allow only one buy-in per year, up to that year’s regular “small” Pillar 3a limit.

You cannot stack multiple catch-ups into a single calendar year.

In practice:

- In 2030, you can catch up one missing year.

- In 2031, you can catch up another year.

- And so on — for up to 10 years total.

This prevents people from making massive one-time deductions and keeps the tax impact predictable.

3. I’m self-employed with no pension fund and a large 3a limit (36k+). Can I catch up those missing amounts later?

This is the most frequent — and most painful — question from the self-employed.

Short answer:

Yes, you can make buy-ins — but only up to the small Pillar 3a limit (CHF 7,258 for 2025/26).

Even if your normal annual allowance exceeds CHF 36,000, the catch-up is always capped at the smaller limit.

The consequence:

If you skip a year with large contribution room, most of that room is gone forever. You can only recover around 7k — not the full amount you originally could have contributed.

For the self-employed, this makes consistent annual contributions especially valuable.