I don’t know if you thought about changing your health insurance when you’re planning to be a mum.

Thinking about starting or growing your family is a big deal. Optimising your health insurance for pregnancy and birth probably isn’t at the very top of your priority list—and honestly, it doesn’t have to be. But once you decide this is the right time in your life, job and relationship to have a child, tweaking your health insurance becomes something worth thinking about—let’s put it somewhere between “find a bigger flat” and “look up childcare options” — not at the very top, but definitely on the list.

When I knew I wanted a baby, I started looking at my health insurance with fresh eyes.

This is how I approached it — as an actuary, but also as a future mum who wanted comfort, calm, and a bit of control over the experience.

Full disclosure: your timeline will almost certainly differ. But the data show that women in Switzerland are now having children later: the average age of first-time mothers hovers around 32 years and is increasing (Source: Swiss Federal Statistical Office). That means many of us are planning ahead anyway—and if you’re in that camp, this subject is relevant.

Also because this is a frequent question I get from friends and mom-friends (“What did you pick?”). So here you go.

What Basic Health Insurance Really Covers During Pregnancy

In Switzerland, basic health insurance (Grundversicherung) is mandatory and covers pregnancy and childbirth — but with limits.

The good news is that once you’re pregnant, no deductible (Franchise) and no 10% co-payment apply for maternity-related care. Every expectant mother is fully covered for regular check-ups, ultrasounds, hospital birth in her canton of residence, and postnatal midwife care.

And here’s the even better news: from the 13th week of pregnancy until 8 weeks after birth, women pay no deductible (Franchise) and no 10% co-payment for all medical treatment covered by basic insurance — even when it’s not directly related to the pregnancy. (Source: Federal Office of Public Health – bag.admin.ch and my own experience).

In other words, you’re in a special pregnancy health window where all care under basic insurance is fully paid by your insurer. Whether you catch the flu, visit a dermatologist, or simply want an extra check-up, you won’t pay anything out of pocket.

The only exceptions are services that are never covered under basic insurance, such as most dental work or purely cosmetic treatments.

Adjusting Your Franchise When You’re Expecting

This is important: if you have a high Franchise — say CHF 2,500 — you’re not losing anything when it comes to pregnancy care. From the 13th week of pregnancy until 8 weeks after birth, all medical services under basic insurance (KVG/LAMal) are fully covered. There’s no deductible and no co-payment during that period.

So instead of paying higher premiums for a lower Franchise, it makes sense to use that difference for supplementary insurance — or simply to save and invest the money for your baby’s future.

You can adjust your Franchise once a year, effective for the following calendar year.

To increase it (for example, from CHF 300 to CHF 2,500), your insurer must receive the request by 31 December.

To decrease it, the deadline is 30 November.

And yes — you can still raise your Franchise even if you’re already pregnant.

So far, so good. But if you’re dreaming of a private room, choosing your own doctor, or joining prenatal and postnatal courses, that’s where supplementary insurance (Zusatzversicherung) enters the story.

Set Your Priorities

When I knew I wanted a baby, I already had a few non-negotiables:

• A private room in the hospital (because sleep is sacred).

• I hoped to have the same doctor at birth as during pregnancy (to avoid a stranger walking in at the last minute).

So I looked for insurance with private, semi-private or flex coverage. The flex option—fewer people know about it—turned out to be the most cost-effective for me: private comfort without the full private price. You however contribute to every hospital night stay.

Your priorities may look different. Maybe you don’t mind sharing a room and prefer the energy of other new mums nearby. The key is simple: write down your top 2–3 must-haves. It makes every next decision easier.

Private vs Semi-Private: The Room Service of Birth Plans

Think of basic insurance as flying economy — safe, reliable, and gets you there.

Supplementary insurance? That’s business class. You get to pick your doctor, choose your hospital, and enjoy a single room with better food.

Semi-private coverage means you share a room with one other person. You can upgrade to single room if available. It gives you access to private hospitals like Hirslanden and allows you to pick the doctor.

Private coverage means the room — and the doctor — are all included and you won’t have to pay extra for upgrades.

In a flex private model, you have private coverage but pay a per-night contribution.

But here’s the catch: you need to buy this before you’re pregnant. Once there’s a baby on the way, insurers treat that as a “pre-existing condition” — and applications are usually denied. Most insurers apply a 12-month waiting period before maternity benefits kick in.

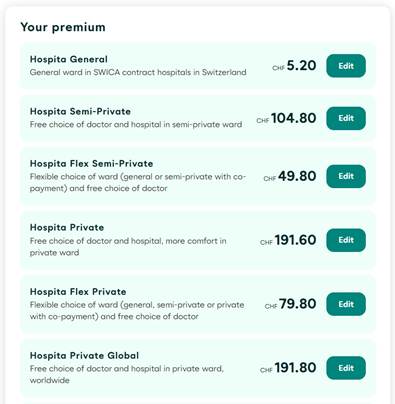

To give you a ballpark idea of prices you can expect:

Here are some examples of hospital insurance premiums — they vary depending on your age and your Gemeinde (place of residence).

Have a Look at Hospital Pages & Price Reality

Once I had my priorities, I used a hospital benchmark. For example, I looked at the maternity unit pages of Klinik Hirslanden in Zürich (and its branch Klinik Im Park) to see typical costs for upgrades.

For instance:

• At the Hirslanden maternity unit, upgrading from basic to private insurance is listed at CHF 11,500 per stay.

• From semi-private to private: around CHF 3,500 per stay.

This gave me a ball-park: “Okay, if I really want a private room and my stay is 3–5 nights, how much extra would it cost?”

Calculate Your Cost

Here’s where the “actuary mindset” really helps. Instead of guessing, I calculated: What will this cost me out-of-pocket? What will the savings be?

If you don’t have semi-private or private hospital insurance, you can still upgrade at the hospital — but you’ll pay the full difference yourself.

| Hospital Insurance | 18-Month Premium (CHF) | Upgrade Cost (CHF) | Expected Nights | Total Cost (CHF) | Notes |

|---|---|---|---|---|---|

| Basic | 0 | 11’500 | 4 | 11’500 | Pay full upgrade; cheapest premium, highest out-of-pocket |

| Semi-private | 1’886 | 3’500 | 4 | 5’386 | Pay premium + upgrade fee |

| Private | 3’449 | 0 | 4 | 3’449 | Everything covered |

| Flex private | 1’436 | 1’600 | 4 | 3’036 | Smart middle ground |

| Flex semi-private | 896 | 4’700 | 4 | 5’596 | Semi-private + upgrade + per-night contribution |

In my case, I assumed I’d pay the premium for about 18 months — since hospital insurance can only be cancelled at the end of the year, and with the 12-month waiting period, that’s a realistic timeframe. Babies don’t always follow our calendars anyway. I also based my calculation on a four-night stay.

Under flex private, you contribute CHF 400 per night if you choose a private room.

Under flex semi-private, you first pay an upgrade fee of CHF 3’500, then CHF 400 per night.

So once I extended the stay to five nights, flex private and full private came out nearly the same in total cost.

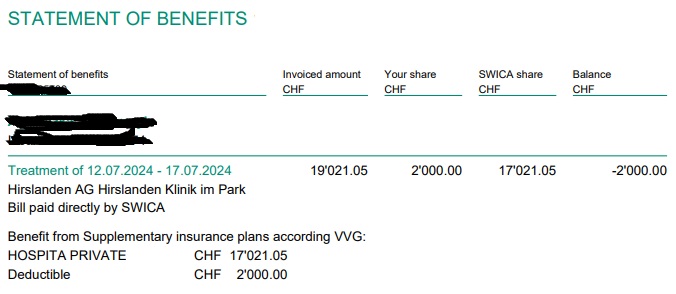

For me, flex private was the clear winner: private comfort at the best overall price of CHF 3’000 for a typical four-night stay. I even checked my hospital bill from 2024 — it came to CHF 19,021 in total. The insurance paid CHF 17,021, and I covered CHF 2,000.

And beyond the numbers — the experience mattered. In private wards, partners often stay overnight at no extra cost. We did, and those first five nights with our baby is a wonderful memory. The midwives had time to teach us how to care for our baby and help us rest before heading home to face the real world — and the laundry. We repeated the same experience three years later with our second child, and it was just as special.

Both my pregnancies were insured with SWICA (basic and hospital cover), and I was genuinely happy with their maternity support. If you’re comparing providers, you can check out SWICA’s insurance options here. This is an affiliate link — it helps support the blog at no extra cost to you.

So, if you’re aiming for a private hospital stay, full private insurance usually makes sense once you factor in longer stays or planned C-sections. But if you expect a natural birth and shorter recovery, flex private often offers the best balance of comfort and cost.

The Extra Perks of Private Hospital Insurance

Private hospital insurance isn’t just about a single room and your own doctor. It often includes extra recovery benefits such as home help, home nanny when you’re ill or hospitalized. And when your baby is born, the newborn is usually insured under your policy during your stay — the same comfort, the same cover.

What If You Only Care About the Private Room?

For some parents, the private room is the main priority — not the extra benefits that come with full private insurance. If that’s you, there’s good news: in most Swiss hospitals, you can upgrade just the room and pay the difference yourself.

For example, Spital Zollikerberg lists an upgrade from a shared to a private room at around CHF 3,000–4,000 per stay (as of 2024), depending on availability and length of stay. The good news is that you don’t need to decide a year in advance — you can often request the upgrade once you’re admitted. The bad news is that it depends entirely on availability. If the private ward is full, you’ll stay in a shared room no matter how much you’re willing to pay.

So, if having that private room is non-negotiable for you, planning ahead pays off. With private insurance taken at least 12 months before birth, you get guaranteed access and many more benefits — often for a total cost that’s actually lower than paying for a one-time upgrade.

Other Supplementary Insurances Worth Considering

Hospital cover isn’t the only upgrade that can make a difference during pregnancy. Some supplementary health plans include benefits that go well beyond the delivery room.

If you’re interested in birth-preparation courses, alternative therapies like acupuncture, homeopathy, or hypnobirthing, or extra postnatal support, these plans can be worth a closer look. Many also contribute to baby massage, postnatal exercise, and breastfeeding consultations, and some even offer a small breastfeeding allowance as a reward for nursing longer.

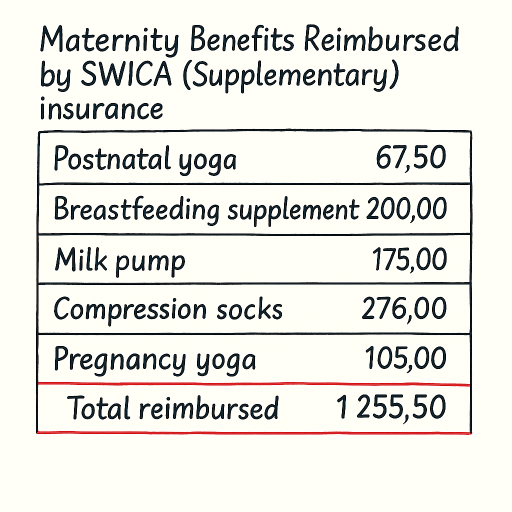

To show you a benchmark I checked my benefit statements from supplementary insurance and added up how much I actually received compared to the premiums I paid.

My annual premium for supplementary insurance was CHF 44.40 × 12 = CHF 532.80.

In other words, the maternity benefits I used were worth more than twice my yearly premium — and that’s without counting the peace of mind that came with it.

If you value comfort, prevention, or complementary medicine as part of your pregnancy journey, it’s worth checking what your supplementary policy already includes — or what a modest upgrade could add.

Why You Should Insure Your Baby Before Birth

This part often surprises first-time parents: you can – and should – insure your baby before they’re born.

If you register your child with your insurer during pregnancy, their cover starts the moment they arrive — even if the birth comes early or your newborn needs immediate medical care. It’s one of those quiet administrative details that can save a lot of stress later.

If you wait until after birth, the insurer can request a health declaration for the baby — and in rare cases, decline or restrict coverage. Pre-registration avoids that completely.

I’ve written a separate post explaining why early registration is essential, what it covers, and how to do it step by step. You can read it here: [post in preparation — if you’d like the next guide when it’s ready, you can sign up here].

Pick the Health Insurance Model That Fits Your Life

When I was comparing options, I eventually chose a Private-Flex plan. For me, it struck the right balance — a private room when I needed it, without paying the full private premium every month. I accepted the small per-night contribution, and the numbers simply made sense.

That was my logic. Yours might be different.

Maybe you want full private comfort and zero surprises on the bill. Maybe you’d rather keep things simple and save the premium difference for your child’s first year. There’s no one “right” answer — only the version that fits your life, your values, and your budget.

When you’re comparing, ask yourself:

• Does my insurer offer a flex option, or only full private?

• What if there’s a complication (C-section, NICU, longer stay)?

Those questions usually lead you to the plan that quietly gives you the most peace of mind.

A Final Thought

Planning for a baby is never just about the practical things — it’s equal parts emotion, logistics, and hope. Health insurance might not feel like the exciting part, but it’s one of the few things you can plan calmly, before life gets louder.

So here’s my take: choose the cover that supports you without weighing you down. When two plans protect you equally, pick the one that leaves a little more breathing room in your budget — and in your head.

Now I’m curious — if you’ve been through this yourself, what mattered most to you when choosing your insurance for pregnancy?

Was it comfort, flexibility, or cost? I’d love to hear your story.