The proven way to repay your mortgage in Switzerland isn’t to send more after-tax money to the bank — it’s to use your pension system intelligently. With Zurich property prices where they are, becoming debt-free can feel painfully slow. Becoming debt-free is less about sacrifice and more about structuring your money so it works for you.

When I bought my first home, I knew I wanted to be debt-free one day — but I also knew I didn’t want to spend decades watching a seven-figure mortgage barely move. Then, when I used part of my second pillar to make that purchase, I suddenly realised there was a smarter — and more tax-efficient — way to get there.

That’s when it hit me: my second pillar isn’t only there for retirement. Used the right way, it can help me repay my mortgage more efficiently — starting today. In a moment, I’ll show you how CHF 100’000 of savings can turn into CHF 128’000 of mortgage-repayment power.

And that simple loop is what’s now making my home about 28% cheaper.

If you own property in Switzerland, your 2nd pillar can be a surprisingly powerful mortgage tool.

Instead of simply repaying your mortgage with after-tax money, it can make more sense taxwise to first buy in to your occupational pension fund and only later use those funds to reduce your mortgage.

Why? Because the buy-in gives you an immediate tax deduction — and that tax saving is larger than the tax you’ll eventually pay when you withdraw the money. In other words, more of your money stays in your pocket instead of disappearing into the tax system.

This isn’t something most homeowners are ever shown — and it only works because Swiss mortgages behave very differently from what people expect.

Why Swiss mortgages are different

It’s crazy to keep a mortgage forever and repay only the interest — that was my first reaction when I learned how Swiss mortgages actually work.

You need around 20% down payment to buy a home.

Then you’re required to repay just 15% of the purchase price over the next 15 years.

And that’s it.

After that, there is no obligation to fully repay the loan. You can, in theory, keep a large part of your mortgage indefinitely and only service the interest.

In most other countries, a mortgage is a slow march toward zero — every month you repay both capital and interest until the debt is gone.

In Switzerland, you only need to amortise about 35% of the property value in total.

It took me a while to internalise this. But eventually I began to see the logic.

From a tax perspective, a mortgage appears as a large negative asset on your wealth tax statement. Under today’s rules, mortgage interest could also be deducted from your taxable income.

So the system encouraged people not to rush into full repayment. But the rules are changing now.

I’ll be sharing more posts about buying property and understanding Swiss mortgages — if you’d like the next guide when it’s ready, you can sign up here.

Now let me show you exactly what I mean when I say a proven way to repay your mortgage in a smarter, more tax-efficient way. It sounds abstract, so let’s look at a real-life example.

The Smart Mortgage Loop — the strategy in one picture

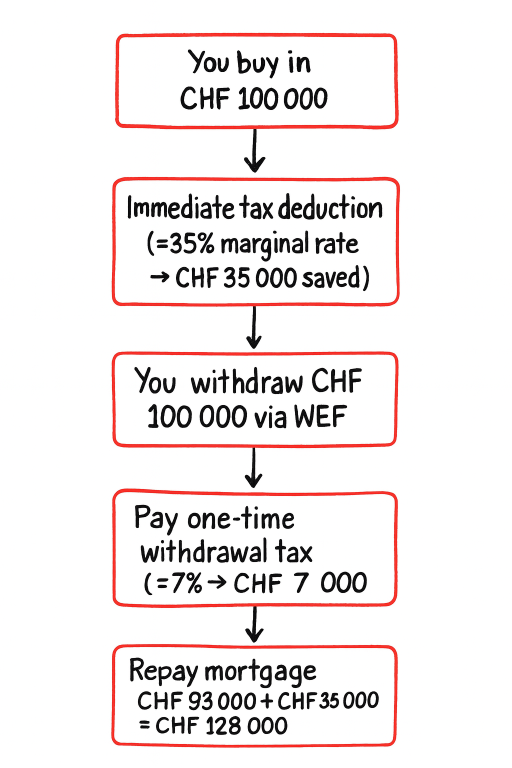

Here’s a simple example:

Think of the diagram as a simple loop.

You start by making a CHF 100’000 buy-in to your Pillar 2. Because buy-ins are tax-deductible, the tax office effectively becomes your silent partner. At a 35% marginal tax rate, it gives you CHF 35’000 back in lower taxes that same year.

Nothing dramatic happens next. You wait.

A few years later — when it makes sense for your mortgage — you use WEF to withdraw that same CHF 100’000 from your pension fund. This time there is tax, but it’s the special capital-withdrawal tax, not income tax. At roughly 7%, that’s about CHF 7’000.

So how much of this actually goes toward your mortgage?

You paid CHF 7’000 on the way out, but you already saved CHF 35’000 on the way in.

That means your original CHF 100’000 of savings didn’t just become CHF 100’000 of repayment power — it turned into CHF 128’000.

It’s not magic, it’s just good sequencing: buy in → deduct → withdraw later.

And let’s be honest — in today’s Swiss property market, your mortgage is probably closer to CHF 1’000’000 than CHF 100’000. That’s why this loop really matters: when you repeat it over time, those seemingly “small” tax savings can grow into hundreds of thousands of francs.

CHF 1’000’000 → approx. CHF 280’000 in tax saved

CHF 100’000 → approx. CHF 28’000 in tax saved

Of course, these figures assume a 35% marginal income tax rate and a 7% withdrawal tax — a realistic example for a high earner in Zurich. Your own numbers may differ, but the logic remains exactly the same.

How this compounds over time —and grows into seven figures

This loop isn’t necessarily a one-time move — but it does require you to front-load your buy-ins. After you make a withdrawal, you are generally not allowed to make new buy-ins until the withdrawn amount has been repaid. Any buy-in made after the first withdrawal is therefore treated as a repayment: it allows you to reclaim the capital withdrawal tax you paid, but it no longer reduces your taxable income at your marginal tax rate.

Under Swiss WEF rules, an advance withdrawal is normally allowed once every five years. That means if you still have several five-year windows before retirement — and your pension fund’s regulations allow it — you can withdraw more than once.

In practice, the cycle looks like this:

buy-in 1 + buy-in 2 + … → wait → withdraw via WEF → reduce your mortgage.

I show a concrete example how this repayment strategy works in a separate post: A proven way to repay your mortgage — a concrete example.

Over a long time horizon, this strategy can compound in the background — provided you respect your fund’s limits and the three-year blocking rule.

Your personal buy-in capacity in the second pillar may be lower than CHF 1’000’000 — the exact amount is shown on your annual pension benefits statement.

New to Pillar 2 buy-ins?

I walk through the numbers, limits, and real-world timing in my post: Pillar 2 vs Pillar 3a: How to Choose the Best Strategy.

Why this isn’t just about debt — it’s about long-term wealth

Although I’m not a big fan of debt, I must admit that in Switzerland a mortgage with a fixed interest rate at around 1.5% can be a reasonable form of borrowing (1.5% is a realistic assumption for a 10-year fixed mortgage).

Now we can’t ignore the fact that when you use a smart mortgage loop your money isn’t sitting idle — it’s compounding.

Instead of repaying your mortgage with after-tax money, you put the same amount into your second pillar — where it can compound over time. Even if we assume a modest return of around 3% per annum, the difference becomes meaningful.

In 2025 and 2026 the legally guaranteed minimum interest rate in the second pillar was 1.25%, but in reality most pension funds credit more than that, for example often 6-8% in recent years. My own pension fund has an average return of over 4% per annum over the last 20 years.

So here is the real choice:

Would you rather use your savings each year to reduce a mortgage that costs you 1.5% per annum — or place that same money into a locked pension account that compounds at around 3% per annum, gives you an immediate tax deduction, and only later use it to repay your mortgage?

When I look at it this way, the answer is simple.

The details that really matter

- The three-year blocking rule applies between buy-in and withdrawal. It’s usually a rule from the tax office, not from your pension fund.

- You’ll pay withdrawal tax (lower than income tax). However, the law is changing. More about it in my next post.

- This strategy works best for homeowners in higher tax brackets who plan to stay in the property long term.

- If you sell the home, the withdrawn capital usually must go back into a pension fund. However, you will get back the tax you paid. You have to apply to your Steueramt to get it back within 3 years from repayment.

New to WEF withdrawals?

I explain the details, numbers, and timing considerations in my post: Using Your Pension Fund to Buy a Home (WEF Withdrawal Explained)

My practical conclusion

Like many homeowners, I want the peace of mind of being mortgage-free one day. And as an actuary, I can’t ignore the numbers — there really is a smarter, more tax-efficient way to get there.

Your 2nd pillar pension isn’t just for retirement. Used strategically, it can help you repay your mortgage faster and at a lower overall cost — a small shift in sequence that can make a big difference over time.

I haven’t seen this explained this way anywhere else. The tools themselves aren’t new — buy-ins, WEF, tax deductions — but thinking about them together as one clear, repeatable mental model completely changed how I do my mortgage repayment.

If you found this post helpful, please leave a comment or share it with someone who’s also navigating the Swiss pension and mortgage maze. I’d love to hear how you’re approaching your own “smart mortgage” strategy.