Short answer:

For most healthy adults in Switzerland, the cheapest and smartest setup is:

Telmed / Pharmacy model + CHF 2 500 franchise + reputable insurer (like Helsana, SWICA, ÖKK, or CSS).

You’ll get exactly the same legal benefits as everyone else — but pay 20–30 % less.

If you want the reasoning, numbers, and logic behind it, keep reading.

Most people open a comparison site, see dozens of numbers, and give up.

But choosing health insurance in Switzerland isn’t complicated when you think like an investor, not a panicked patient.

But beneath the complexity, it’s really a three-step decision:

1. Choose your model (how you access care).

2. Choose your franchise (how much risk you take).

3. Find a reputable insurer offering the cheapest combo.

That’s it. Everything else is noise.

Step 1 — Choose Your Model (That’s Where Real Savings Hide)

Every Swiss basic insurance (KVG / LAMal) covers the same medical benefits.

What actually changes — and what determines your premium — is who you contact first when you need care.

Many expats are surprised to discover that there are different “models.” These don’t affect what’s covered, but they define your first point of contact in the healthcare system.

In practice, that means choosing between three main setups: your family doctor, a telemedicine line, or standard free choice of doctor.

Same coverage, different cost.

| Model | How it works | Typical saving | Best for |

| Standard | You can see any doctor or specialist directly. | – | You want full freedom and don’t mind paying for it. |

| GP / HMO | You must go through a designated GP or network first (paid visit). | ≈ 15–25 % | You like having one doctor who knows your history. |

| Telmed / Pharmacy | You call a hotline or visit a partner pharmacy first — this triage step is free. | ≈ 20–30 % | You’re healthy, rarely need doctors, and want to save. |

Same benefits, different entry points.

Think of Telmed / Pharmacy as the “digital-first” door:

same care, fewer steps, and a smaller bill.

In GP/HMO models, you pay for the first visit to your doctor.

In Telmed, the first call is free.

So if you’re healthy, the savings are real — just don’t pay for optionality you never use.

Why Insurers Offer Lower Premiums for Telemed or GP

It’s not generosity — it’s math.

When you start with a tele- or pharmacy consultation, small issues are handled early and cheaply:

- 90 % of GP consultations never go to a specialist.

- Around 50 % of telemedicine calls are solved with advice alone.

- And 84 % of pharmacy visits end right there.

That means fewer specialist bills and hospital stays — the most expensive part of the system.

Insurers pass part of that saving back to you as a 20–30 % premium discount.

You agree to start at the cheapest effective door, and both you and the insurer save on the bill.

Personal note:

I’ve always chosen the Telemed or Pharmacy model — I don’t like paying for a doctor’s visit just to get a referral when I already know I need a specialist.

In practice, you don’t need to call Telemed for certain cases such as gynecological check-ups, pediatric visits, or emergency situations. For recurring treatments, like psychological therapy or physiotherapy, you usually make one initial Telemed call, and the authorization remains valid for about six months (depending on your insurer’s rules).

Of course, I’d prefer the freedom to choose any doctor — but the savings of around 1000chf annualy from the Telemed model are significant enough to make that small inconvenience worth it.

Step 2 — Choose Your Franchise (Deductible)

Next, decide how much risk you want to take before insurance starts paying.

The franchise you pick is not about guessing. It’s a capital allocation decision. You’re choosing between a smaller certain cost (high premiums, low deductible) and a larger uncertain cost (lower premiums, higher deductible). Warren Buffett would smile at the simplicity: look at cash and odds—and ignore the noise.

Let’s do exactly that.

| Franchise | When it makes sense | Premium impact |

| CHF 300 | You often visit doctors or have ongoing treatments. | Highest premium, lowest risk |

| CHF 2 500 | You’re healthy, rarely need care. | Lowest premium (≈ 15–25 % less) |

The investor’s way to choose a deductible (no guesswork)

Think like this:

Total annual cost = Annual premium + Your out-of-pocket for care.

Your out-of-pocket equals:

- If medical bills are below your deductible: you pay those bills in full (up to the deductible), insurance pays nothing.

- If your bills exceed the deductible: you pay the deductible + 10% of the rest, but not more than CHF 700.

So to choose a franchise, compare two totals for a few realistic medical-spend levels (e.g., CHF 0, 3000). The deductible that yields the lower total most often—weighted by how you actually use care—should be your pick.

Example

To make this concrete, here are the real numbers from SWICA’s 2025 Telmed model.

With a CHF 300 franchise, the monthly premium is CHF 425.

With CHF 2,500, it drops to CHF 306.

That’s a CHF 1,428 difference per year — before you’ve even seen a doctor.

Now let’s compare the two franchises in two simple scenarios:

a year when you barely need care, and a year when the medical bills stack up a bit more.

🟦 = CHF 300 franchise

🟩 = CHF 2,500 franchise

| Medical bills | 🟦 Total cost (CHF 300 franchise) | 🟩 Total cost (CHF 2,500 franchise) | Cheaper |

|---|---|---|---|

| 0 CHF | 5,100 | 3,672 | 🟩 CHF 2,500 franchise |

| 3,000 CHF | 5,100 + 300 + 270 = 5,670 | 3,672 + 2,500 + 50 = 6,222 | 🟦 CHF 300 franchise |

In healthy years, CHF 2 500 clearly wins. In high-spend years, CHF 300 can be a few hundred cheaper. Most families land closer to the first case — paying more in premiums than in actual bills and switching to higher franchise could save them money. Let’s see when the advantage of the higher deductible starts to disappear.

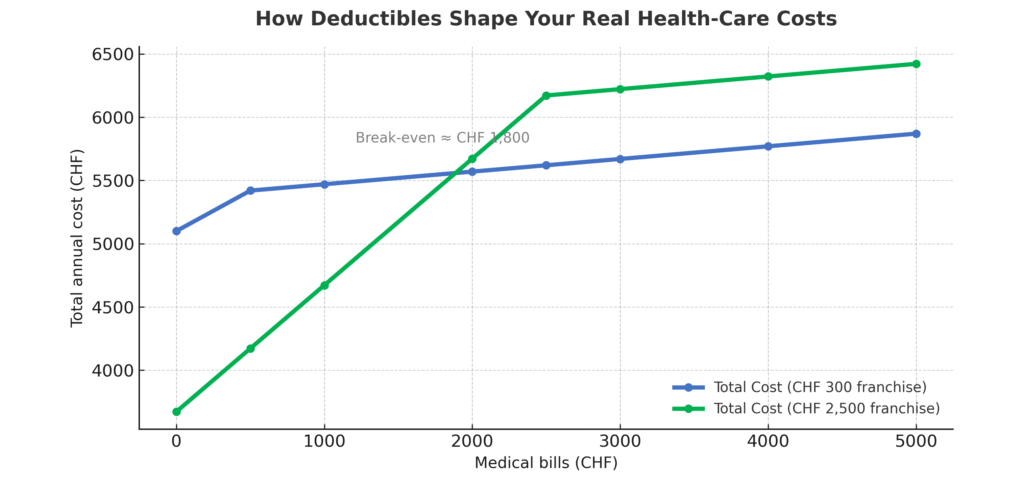

I ran the numbers through my breakeven calculator to see how these two franchises play out in real life. The model includes all the moving parts — premiums, franchise, co-payments, and the legal limits on those co-payments. Here’s the picture that emerges.

A higher deductible (CHF 2 500) costs less in healthy years but becomes more expensive once annual medical bills exceed around CHF 1 800.

Quick action: Before you go further, check the premium difference between CHF 300 and CHF 2 500 for your insurer and canton.

That single number — usually somewhere between CHF 1,200 and CHF 1,600 a year — already tells you 80% of what you need to know.

Takeaway

Most people spend under CHF 1 000 a year on healthcare. And care usage is highly consistent by person (low users stay low) — so unless your medical bills are clearly above CHF 1800, the CHF 2500 franchise usually gives you better value.

Quick action: Check your own medical bills from the last one to two years. You can usually find them in your insurer’s app or your e-bills. Add up what you personally paid.

That one number tells you far more than any comparison site. If your real spending is consistently low (as it is for most people), the CHF 2 500 franchise often becomes the obvious choice.

The Little Safety Net Nobody Talks About

What most people miss — is that Swiss health insurance has a quiet safety net built in.

Yes, you pay your franchise first. And yes, after that you cover 10% of the remaining costs. But that 10% has a hard ceiling: CHF 700 per year for adults, CHF 350 for kids. That’s it. Once you hit the limit, your insurer takes over completely.

Take a CHF 10 000 medical bill. You’d pay your 2 500 franchise, and normally 750 in retention… but the law stops you at 700. Total damage: 3 200 francs. Predictable, even in a bad year.

It’s a small rule, but it keeps Swiss healthcare from becoming a financial free-climb — and it’s reassuring once you know it’s there.

Deadlines

You can adjust your Franchise once a year, effective for the following calendar year.

To increase it (for example, from CHF 300 to CHF 2,500), your insurer must receive the request by 31 December.

To decrease it, the deadline is 30 November.

Risk vs Uncertainty — The Logic Behind It

When you pick your Swiss health-insurance franchise, you’re not just choosing a number — you’re deciding how much risk you want to keep and how much to pass to the insurer.

But here’s the nuance most people miss:

It’s risk, not uncertainty.

You already know the rules of the game:

- The maximum you might pay (CHF 2 500 + co-pay).

- The premium you save (maybe CHF 1 400 a year).

- The point where one option becomes cheaper than the other (around CHF 1 800 in annual medical bills).

That’s measurable, quantifiable, and predictable.

That’s risk.

Uncertainty would be not knowing the rules at all — a system where costs or coverage could change overnight. But under Swiss law, the system is stable and the boundaries are clear.

So when you choose the higher deductible, you’re not gambling. You’re pricing known risk.

You’re saying: “I’ll take the small, known chance of a larger bill in exchange for guaranteed lower premiums every year.”

That’s what rational decision-making looks like.

“Risk comes from not knowing what you’re doing.”

When you understand your numbers, choosing a high franchise isn’t risky — it’s efficient.

Personal note:

For the past 11 years, I’ve always chosen the CHF 2 500 franchise as i was rarely going to doctors. However, after my last pregnancy I developed back problems and will need an MRI and chiropractic treatments. Once I calculated the likely costs, I decided to lower my franchise to CHF 300 for 2026.

Step 3 — Compare Reputable Providers

Now that you’ve chosen your model and franchise, it’s time to pick the insurer that fits you.

Since basic insurance is identical everywhere, the real differences show up in customer service, digital tools, claim processing, and whether you can get help in English when you need it.

According to Comparis 2025, insurers like SWICA, Helsana and ÖKK consistently score well for overall satisfaction. They offer solid basic coverage (as required by law), decent apps, and reliable service.

On the other hand, providers like Assura are often the absolute cheapest in many cantons. The trade-off is usually slower service, fewer digital features, and a more “no-frills” experience. If you rarely use your insurance, don’t mind handling some paperwork yourself, and simply want the lowest premium, Assura can still be a perfectly fine choice — you just won’t interact with them as much anyway.

Others, like Aquilana, have excellent satisfaction scores too, but more limited English-language support, which can make day-to-day admin harder if you don’t speak German or French.

And if you have more questions check here: Swiss Health Insurance Made Simple: 10 Things Every Expat Should Know

Personal note:

I personally use SWICA for my family — simply because it strikes the best balance between service, app quality, and pricing. You can check them here → SWICA. This is an affiliate link — it helps support the blog at no extra cost to you.

I’ll explain how I optimize the supplementary side in a future post — if you’d like the next guide when it’s ready, you can sign up here. And here are details how I chose the best setup during my two pregnancies.

In the past, I was with CSS and was happy with their service as well, but I switched to SWICA when an employer discount made it the more cost‑effective option for me.

The Calm Conclusion

Swiss health insurance looks complex — but the logic is simple:

Step 1: Choose your model: for most, Telmed / Pharmacy saves most.

Step 2: Set your deductible: CHF 2 500 if healthy, CHF 300 if not.

Step 3: Pick a trusted insurer: same cover, different price.

If two policies buy you the same protection, choose the one that leaves more money in your pocket — and invest the difference.

So now I’m curious — which insurer or model have you found offers the best value for you?