December is busy. Most people have little time — and even less headspace — to think about pensions.

So here is the short version first: Pillar 3a is one of the simplest ways to save taxes and grow long-term wealth in Switzerland, but most people unknowingly make mistakes that quietly cost them thousands.

These are the five most common mistakes:

- Keeping 3a in cash instead of investing

- Paying high fees at traditional banks

- Paying in only once a year, usually in December

- Holding only one 3a account, causing a tax shock later

- Never reviewing the strategy, even when life changes

If you want the explanations, examples, and what to do instead, here’s the full breakdown — simple, practical, and based on how the system really works.

Mistake #1 – Treating 3a like a savings account

Many people open their 3a at the same bank where they keep their salary account. It feels simple, familiar, safe.

They end up in a cash-based 3a earning 0.15–0.20% interest — the standard rate at most large banks today. That’s not a return. That’s a parking lot.

Why it’s a problem:

Inflation quietly erodes your purchasing power. And even though inflation in Switzerland is low, the effect is still meaningful over long periods. If the past can be any guide, prices rose 11.4% between 2004 and 2024 according to the official inflation calculator. If your money doesn’t grow at least as fast, you’re not standing still — you’re moving backwards.

But the bigger issue is the opportunity cost. Money sitting in cash for 10, 15, or 20 years isn’t working for you — it isn’t compounding. Compounding is the closest thing to magic in finance. But it only works if you give it time and give it fuel. Cash gives it neither. Over time, that gap becomes enormous.

And to be honest? Many people simply don’t know that investment-based 3a accounts exist. I’ll admit — when I first moved to Switzerland, I also parked my 3a in cash because I didn’t know better.

Do this instead:

Ideally choose an investment-based 3a (like Finpension 3a, VIAC, or Frankly) that allows 60–99% equity allocation. Even with market ups and downs, long-term returns are far higher.

And if you prefer staying with your bank, check their equity-based 3a solutions — many people don’t realise that banks also offer investment 3a accounts. In fact, Finpension, VIAC and Frankly all use UBS or Swisscanto index funds underneath. Banks often come with higher fees, but the core idea — investing instead of sitting in cash — is the same.

Mistake #2 – Keeping only one 3a account

Most people do what feels simplest: they open one 3a account and forget about it.

It works fine — until the day it doesn’t.

Here’s the part many people learn too late. By law, in Switzerland, you’re free to hold several 3a accounts. There’s no limit.

However under Swiss law, each 3a account (pillar 3a) can only be withdrawn in full once.

You cannot make partial withdrawals from the same account at different times. (Source: fedlex.admin.ch – BVV 3 (Art. 3))

Yet most people keep just one — and later face a big tax shock when they withdraw everything at once for retirement. The only exception is when you withdraw for your own home under the WEF rules.

Why it’s a problem:

Lump-sum withdrawals are taxed progressively, so splitting into 3–5 accounts and withdrawing them over several years can cut your tax bill by 10–30 %.

Do this instead:

Open a new 3a account every few years.

When you retire (or withdraw early for home purchase), you can stagger the withdrawals.

Small steps today. Big difference tomorrow.

That’s compounding — not just of money, but of good decisions.

Mistake #3 – Waiting until December to contribute

Most people treat Pillar 3a like an end-of-year errand.

They wait until December — often the busiest, most chaotic month of the year — and then rush to push their contribution through just before the deadline.

Why it’s a problem:

You miss out on months of potential investment growth every year.

If you invest only once annually, your average time in the market is much shorter.

If your plan is to contribute right before Christmas, you’re putting a lot of faith in the most hectic month of the year. People forget — that’s normal. Until now, a missed payment was lost forever. With the 2025 reform, you get a second chance: you can catch up on missed 3a contributions, provided you follow the new rules. That’s a great opportunity, but it doesn’t replace good timing — it complements it. I put together a short post that explains how the 2025 Pillar 3a reform works and what it means in practice.

Do this instead:

Set up monthly or quarterly contributions. Most 3a providers let you automate this right in your account. Doing so naturally smooths out market fluctuations (a simple form of dollar-cost averaging) and keeps you disciplined without the year-end scramble.

Small changes like this — a little discipline, a little foresight — add up more reliably than last-minute miracles.

Mistake #4 – Ignoring fees

Fees compound too — but in the wrong direction.

Many traditional banks still charge 1 %+ in total costs, while digital providers are closer to 0.4 %.

Why it matters:

Imagine the difference between paying 1% vs. 0.4% in fees year in, year out, for 25 years. The gap doesn’t look like much on paper — just a few tenths of a percent — but over decades, that drag eats into the very compound interest you’re trying to build. In many realistic scenarios, that difference adds up to tens of thousands of francs by the time you withdraw.

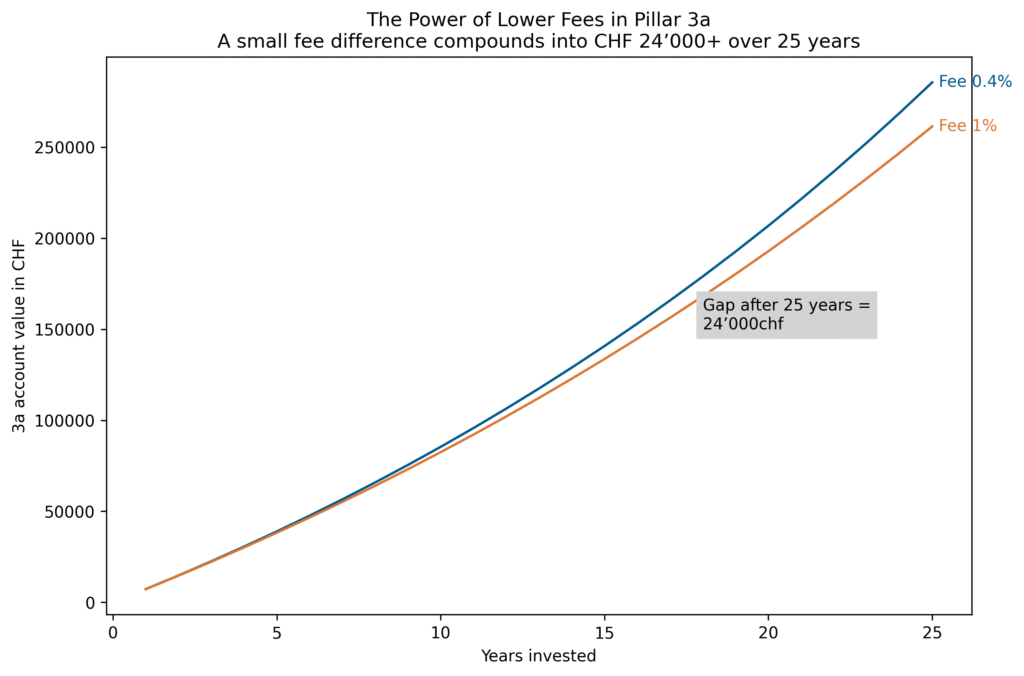

This chart shows how much of a difference fees make in a Pillar 3a account over the long run. The calculation assumes a simple setup: CHF 7000 contributed each year and a 4% annual investment return. The only thing that changes is the fee — 0.4% versus 1%.

At first, the two lines sit almost on top of each other. But as the years pass, the gap quietly widens. After 25 years, the lower-fee option leaves you with roughly CHF 24’000 more, even though everything else was identical: same contributions, same return, same timeline.

Do this instead:

Compare total expense ratios (TER).

Platforms like Finpension 3a (0.39 %) or VIAC (0.41 %) consistently rank among the lowest-cost options.

In the long run, paying less in fees is one of the surest ways to keep more of what you earn. Let your money work for you, not for someone else’s profit margin.

Mistake #5 – Forgetting to review your investment strategy

Life changes — salary, risk tolerance, family situation, retirement goals.

But most people never log in to check if their 3a still fits their situation.

Why it’s a problem:

Here’s why that matters: an overly conservative allocation or a fund mix that hasn’t been touched in years quietly steals growth. Stocks and bonds don’t move at the same pace every year, and what made sense five years ago might not make sense today. Letting your portfolio drift away from your goals is like steering a ship off course and not bothering to check the compass.

Do this instead:

Review your 3a once a year:

Look at your equity percentage: Does it still match your appetite for risk and your time horizon?

Adjust as you near withdrawal: In the last 5 years before you plan to take money out, it often makes sense to dial down risk and protect what you’ve built.

A yearly check-in is a small commitment that keeps everything aligned before small drifts turn into big detours.

Takeaway

Most 3a mistakes are not emotional — they’re structural. People set it up once, assume it’s done, and forget that small optimizations compound quietly for decades.

The 3a system is one of the few tax-efficient investment tools available in Switzerland.

If you’d like to understand how 2nd Pillar buy-ins compare, I’ve also written a post on that topic.

Used well, these levers can add hundreds of thousands to your retirement wealth.

Summary – What to remember

| Mistake | What to do instead |

|---|---|

| Keeping 3a in cash | Invest in equity-based 3a |

| Paying >0.5 % fees | Choose Finpension, VIAC, or Frankly |

| Paying in only once per year | Automate monthly payments |

| One single 3a account | Open 3–5 and stagger withdrawals |

| Never reviewing allocation | Reassess yearly, especially before retirement |

I wasn’t immune to these mistakes either. Three of them were part of my own setup before I sat down, did the research, and finally built a strategy that made sense for me.

If sharing this helps someone capture a little more growth — or avoid a costly detour — I’d be glad to hear it.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.