Most people in Switzerland don’t think about their pension until their late fifties — when retirement suddenly stops feeling abstract. By then, the pension system has already been shaping their future income for decades. Pillar 1, Pillar 2, Pillar 3 — they’ve all been growing, deducting, and investing in the background. Yet nearly half of people still say they don’t know what their income will be in retirement. The Swiss pension system isn’t complicated — but the sooner you understand it, the more options you have.

The Swiss pension system is robust—and confusing from the outside. But once you see how the pillars connect, the whole thing becomes surprisingly logical. This guide shows how the three pillars work together, what actually moves your future income, and why a fourth pillar matters just as much. The first three are the official structure. The fourth is the one you build yourself: your own savings, your investments, your independence. That personal layer is what turns the system from “adequate” into “secure.”

When you see the whole picture, the pension system becomes less of a puzzle and more of a set of levers you can actually use. A buy-in here, a 3a contribution there, a withdrawal plan later — small decisions that quietly shape the freedom your future self will have.

And somewhere in the middle of that, I always remember one of my favourite quotes:

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

— Warren Buffett

Pension planning works the same way. The benefits show up years after you make the decision — but you only get those benefits if you understand the system early enough to act.

So let’s walk through the pillars one by one, starting at the foundation — Pillar 1.

Pillar 1 (AHV/AVS) — Switzerland’s Solidarity Pension

State pension based on your contribution history (number of years) and your insured income (including credits for childcare/caregiving). The pension is adjusted periodically based on a combination of inflation and wage developments.

Imagine a long table where generations sit together — those still working and those already retired. Every month, the younger ones place a part of their salary on the table, and that money is used to fill the plates of today’s pensioners.

That’s the idea behind Switzerland’s first pension pillar, the AHV (Alters- und Hinterlassenenversicherung) in German or AVS (Assurance-vieillesse et survivants) in French.

It’s a solidarity system, not an individual savings plan. The contributions you and your employer pay don’t go into a personal account; they flow straight into a shared national pot that funds the current generation of retirees. When your turn comes, tomorrow’s workers will do the same for you.

Because it’s a shared system, it relies on balance — enough people working to support those who have stopped. As Switzerland ages and people live longer, that balance becomes harder to maintain. Fewer workers per retiree mean more pressure on contributions, reforms, or both. The ageing population and rising life expectancy are shaping the future of pensions — a theme I think about often in my daily work. I’m preparing a post on this very topic, so check back soon if you want to know more.

It’s a safety net, not a fortune. In 2025, single retirees receive between CHF 1 260 and CHF 2 520 a month — enough to stay above the poverty line but far from a comfortable lifestyle in cities like Zurich or Geneva. For a married couple, the combined pension is capped at CHF 3,780/month.

Pillar 2 (BVG/LPP)

Occupational pension via your employer. Your “coordinated” or “insured” salary determines contributions (increasing with age). The plan credits interest during accumulation and provides risk benefits (disability/survivor). On retirement, accumulated assets can be paid as annuity or lump-sum (or a mix), subject to plan rules.

If the first pillar is a shared table, the second one is your own plate. Every month, a slice of your salary — and a slice from your employer — is quietly set aside in your name. This is the BVG (Berufliche Vorsorge) in German or LPP (Loi sur la prévoyance professionnelle) in French — Switzerland’s second pillar.

Its purpose is simple: to maintain your standard of living once you stop working. Together with the AHV/AVS, it should replace about 60 % of your final income. Unlike the first pillar’s solidarity pot, the money here is yours: saved, invested, and credited with interest each year.

You can see it growing on your annual pension statement — a quiet reminder that time and compounding are on your side. When you retire, you can choose whether to turn it into a monthly pension, take it as a lump sum, or combine both.

With people living longer, I see declining conversion rates as one of the key risks in the second pillar — your pension might not stretch as far as expected. That’s why I see the option to withdraw as a lump sum as a valuable form of flexibility: it lets you take control if the offered rate doesn’t feel fair. And if life takes an unexpected turn — disability or death — your pension fund is there to protect you and your family.

Is it really your money?

Mostly yes — but not in the way a bank account is. Your Pillar 2 savings are tied to your name, follow you from job to job, and one day become part of your retirement income. Yet they live inside a shared system that’s carefully managed and legally protected. If your employer’s fund ever runs into trouble, the money doesn’t disappear — it’s held in trust and backed by Switzerland’s Guarantee Fund (Sicherheitsfonds LPP / Fonds de garantie LPP). Even the safest systems need a safety net. In Switzerland, that role belongs to the Guarantee Fund — the Sicherheitsfonds BVG in German or Fonds de garantie LPP in French. Every pension fund contributes to it, like an insurance pool that protects all insured members. If a fund ever became insolvent, the Guarantee Fund would step in to cover the mandatory part of your benefits — that is, the part of your salary up to the BVG ceiling (currently CHF 88,200) and transfer them to another healthy fund. The extra-mandatory portion (above the BVG ceiling) isn’t fully guaranteed. To date, only a handful of small funds have required intervention. It’s one of the quiet strengths of the Swiss system — layers of protection built in long before you’ll ever need them. Still, market swings can affect the interest credited or future conversion rates, reminding us that even the safest systems carry a touch of real-world risk.

Quick action: if you read just one document this week, make it your Pillar 2 benefits statement. It’s the most honest snapshot of your future income. I’ll soon share a post to help you read and interpret it with confidence — if you’d like the next guide when it’s ready, you can sign up here.

If you’d like to understand how Pillar 2 buy-ins compare with investing in Pillar 3a, I wrote a full guide here.

Pillar 3 (3a/3b) — Voluntary savings.

- 3a: tax-deductible up to an annual cap; funds are locked until retirement (or specific events), and can be invested (not just cash).

- 3b: savings without tax deduction.

If the first pillar is a shared table and the second your own plate, then the third is the meal you choose to cook.

It’s about closing the gap — the difference between what the first two pillars provide (roughly 60% of your salary) and the lifestyle you actually want in retirement.

The 3a pillar is the structured version: it rewards discipline with tax deductions. You can contribute up to CHF 7 258 a year (2025) if you’re employed, or up to 20% of your income (max CHF 36 288) if you’re self-employed. The money stays locked until retirement or a few life events — like buying a home, becoming self-employed, or moving abroad — but it grows tax-free all the while. You can invest it so compounding has time to work its quiet magic.

The 3b pillar is pure flexibility — any kind of private saving or investing without tax advantages but with full freedom. It’s for everything that doesn’t fit neatly into 3a’s rules: extra investments, property, life insurance, or even an emergency fund.

One small twist most people haven’t heard yet: the rules have just changed in 2025.

You can now catch up on missed 3a contributions — a quiet opportunity that suddenly makes Pillar 3a much more powerful than its reputation suggests. I’m explaining the details (and how to use it wisely) in my post: pillar-3a-retroactive-contributions-2025-reform-buy-in

Pillar 3 is where the system becomes personal — where your choices, discipline, and risk comfort start shaping what retirement looks like for you.

Is Pillar 3b better than investing on your own via broker account?

Not usually. Pillar 3b gives you flexibility and can make sense if you want life-insurance protection or designate beneficiaries directly (e.g. spouse, partner, children). But most 3b products come with high fees and limited investment options, which eat into returns.

If your goal is simply to grow wealth, a low-cost broker account is usually the better choice — cheaper, more transparent, and just as flexible. Think of 3b as a niche tool for protection planning rather than a must-have investment vehicle.

The 4th Pillar — Your Own Financial Independence

Swiss pension system has three pillars on paper — but in practice, everyone should build a fourth.

That fourth pillar is your own savings and investments outside the pension system — the money that stays liquid, accessible, and fully under your control.

It’s the fund that protects you when life doesn’t go as planned — if you’re laid off at 55, take a career break, or face health changes that limit your work. It’s what gives you breathing room before touching your pension assets, and freedom to make decisions on your own terms.

It may not bring tax deductions or legal privileges, but it offers something more important: true independence and resilience.

If I could give just one recommendation to anyone planning their financial future — it would be to build your fourth pillar early.

If you’d like to learn more about the system I use to build financial independence, I’ll be sharing it in one of my upcoming posts — if you’d like the next guide when it’s ready, you can sign up here.

And if you’re wondering where to keep your fourth-pillar investments, I can share what I do myself.

I use DEGIRO — mostly because it keeps things simple: no custody or inactivity fees, very low trading costs, and a wide choice of low-fee ETFs. An di like that it’s a European platform that suits the kind of long-term, steady investing I believe in. Because I’m based in Switzerland, my DEGIRO account is in CHF — I deposit and hold cash in Swiss francs, and when I buy CHF-based ETFs there’s no currency conversion at all.

It’s not perfect — For ETFs in EUR or USD, DEGIRO does charge a small FX fee (0.25% on conversions by default) — but overall it’s been a reliable, cost-efficient home for my own investments. I’m including an affiliate link to DEGIRO here; it supports this blog at no extra cost to you, but feel free to go directly if you prefer. The important part is choosing a platform that helps you start building your fourth pillar early.

Bringing It All Together

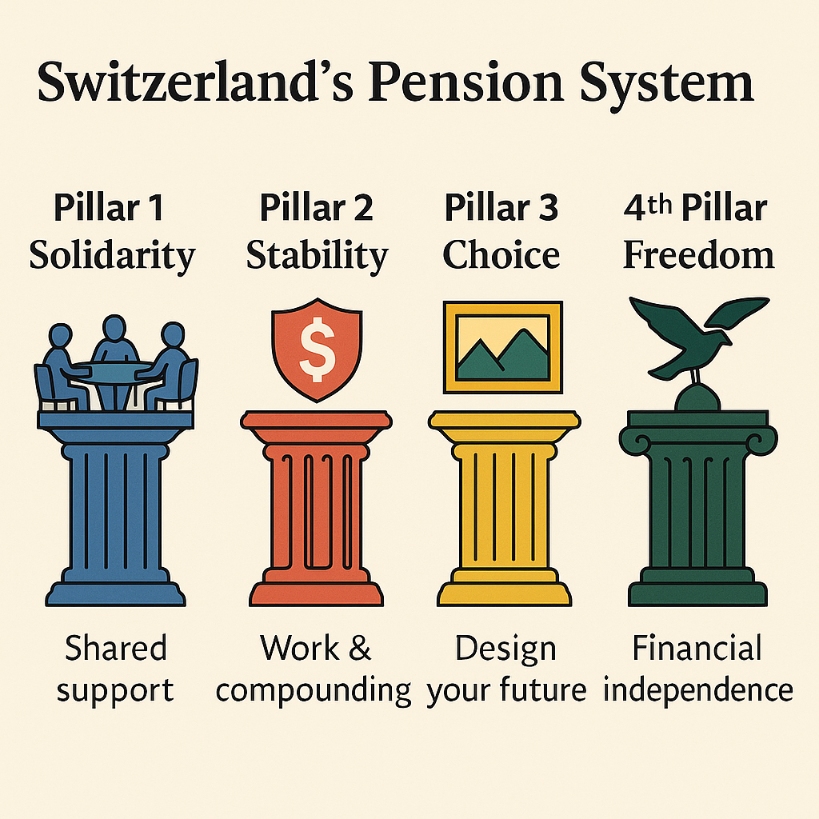

To make the whole Swiss pension system easier to visualise, here’s a simple way to picture four pillars — the structure that holds your financial future together.

Swiss pension system may look complex on paper, but at its heart it’s beautifully balanced.

The first pillar keeps everyone at the table — a shared promise that no one grows old without support.

The second pillar builds stability, turning work and compounding into something tangible and lasting.

The third pillar adds choice — your chance to design the life you want beyond the basics.

And the fourth pillar adds freedom — the financial independence that keeps your choices open, no matter what life brings.

Understanding how these pieces fit together isn’t just about numbers; it’s about ownership.

Each decision — a buy-in, a 3a investment, a withdrawal plan — quietly shapes your future freedom.

The earlier you start engaging with it, the more options you keep open for later.

So maybe the best time to think about your pension isn’t “someday” — it’s today.

Withdrawal Plan — Turning Savings into Freedom

Building your pension is only half the story. The other half is how you take it out.

A well-timed withdrawal plan can quietly save you thousands — not through luck, but through planning.

When retirement comes, every canton in Switzerland taxes lump-sum withdrawals differently, and the rates rise as the amounts grow. For example, withdrawing CHF 100 000 from your 3a account might cost roughly CHF 4 900 in Zürich, but only about CHF 1 600 in Schwyz, depending on the setup. Scale that up to CHF 250 000 or CHF 500 000, and the difference widens fast because the tax is progressive.

It’s one of those details few people think about until the moment arrives — yet it can shape how much of your lifetime savings you actually keep.

A thoughtful withdrawal strategy — staggering payments over several years or foundations, or even choosing where you retire — can make a quiet but powerful difference.

I’ll explore this topic in depth soon, with real examples and step-by-step comparisons — if you’d like the next guide when it’s ready, you can sign up here. For now it’s just food for thought, consider it a gentle reminder: the way you exit the system matters just as much as how you build it.

So now I’m curious… which pension decision do you think your future self will thank you for?

Frequently Asked Questions (FAQ)

1. I have some extra money — should it go into a Pillar 2 buy-in, my 3a, or an ETF?

Imagine you find CHF 10,000 at the end of the year — a bonus, a refund, or simply good savings.

The question becomes: Where does this next franc work hardest for you?

The simplest way to think about it is to start with time.

If your horizon is short — the next few years — a Pillar 2 buy-in often behaves like the quiet, reliable worker.

The tax saving shows up immediately, and it’s only a little affected by what’s happening in the stock market because the fund invests more conservatively and smooths returns over time. It’s the “certain return” option.

But give your money a decade or more, and the story changes.

Over longer horizons, a well-invested 3a or a global ETF starts to let compounding do the heavy lifting.

Small, steady returns begin to snowball, and patience becomes your real advantage.

If you want to see the break-even points, tipping horizons, and how small assumptions flip the winner, I break it down fully here.

2. When I read my Pillar 2 statement, I’m confused — is this money actually mine?

A Pillar 2 statement can feel like opening a box with several smaller boxes inside.

They all belong to you — but each follows slightly different rules.

The mandatory part is the most protected: it has strict legal standards, minimum interest, and a safety net behind it if a pension fund ever ran into serious financial trouble. These cases are rare, but the Guarantee Fund exists specifically for this portion.

The extra-mandatory part is also yours, however employers design it differently, interest can vary, and withdrawal rules may change depending on whether you stay in Switzerland, move to the EU, or go elsewhere.

A simple way to see it is this:

every franc is your franc — it just lives in different sections of the same system.

“Know what you own — and know how it works.”

I’m preparing a full post that walks through a real Pillar 2 statement, line by line — if you’d like the next guide when it’s ready, you can sign up here.

3. Should I withdraw my Pillar 2 as a pension or a lump sum?

It depends on your situation and risk comfort.

A pension (rente) gives you stability and income for life — but the monthly amount can feel modest simply because it has to fund a much longer retirement than it did a generation ago. And as lifespans keep increasing, it’s likely that conversion rates will continue gradually decreasing in the years ahead.

A lump sum offers flexibility and potentially higher long-term returns, but also requires discipline and a plan.

Many people choose a mix: a base pension for stability, and a partial lump sum for flexibility and liquidity.

There’s no universal right answer — just the one that matches your future needs and how comfortably you can manage your own capital.

4. What’s the biggest mistake people make with their pensions?

Waiting too long to look at them.

Here’s a real example:

I often hear from people in their 50s who analyse their Pillar 2 statement for the first time and realise they could have made buy-ins, adjusted contributions, or planned withdrawals more tax-efficiently — but now have only a few years left.

The earlier you look at your pension setup, the more options you have — and the cheaper those options become.